|

| Jon Norris, managing director of Silicon Valley Bank |

By Jon Norris, managing director, Silicon Valley Bank

Non-VC or crossover investors are helping drive the rebound in IPOs among healthcare companies. And it's proving to be a winning strategy for both investors and the newly public companies.

That is one of the key finding of Silicon Valley Bank's Trends in Healthcare Investments and Exits 2015.

Over the past two years, we have seen the emergence of non-VC investors, particularly hedge funds, providing "top-up" financing to IPO-ready companies prior to entering the public markets. These investors are focused primarily on biopharma and have helped propel, and benefited, from the wave of IPOs in this sector.

Their strategy is to get a foothold in the company prior to going public by providing later-stage financing, typically at a discount to the IPO. These investors have realized they can help create significant value by setting up companies for stronger IPOs. Companies view these investors as allies because they tend to be less sensitive to higher company valuations than traditional venture investors, and they provide a sign of confidence to the public markets ahead of the IPO.

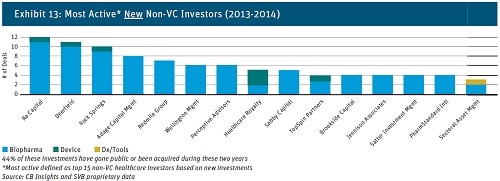

The strategy has been extremely successful for the most active investors, according to an analysis of SVB proprietary data and CB Insights. The top 15 crossover investors, 7 of which are hedge funds, are responsible for 57 unique new lead investments in 2013-14. Of those investments, 25 have achieved an exit as of February 2015: 21 IPOs and four M&A transactions. A 44% exit rate within two years from an initial investment is truly exceptional.

Companies that received investments from this group had more successful IPOs, reflected in significantly higher pre-money valuations and dollars raised. Median pre-money valuations were 52% higher ($211 million vs. $139 million) and dollars raised at IPO were 485 higher ($96 million vs. $65 million) than their peers without crossover investment during the 2013-14 IPO window.

And that's only first half of the story. Post-IPO stock appreciation also soared. Six months after the IPO, these companies had a median value 20% higher than the IPO price, and the average value was more than 70% higher.

We predict, based on the current success of crossover investors, it is likely that biopharma companies ready for an IPO will continue to benefit. We also think this activity will start to spread to device and diagnostics/tools, though the focus in those sectors likely will be in later-stage, commercial companies. We expect top non-VC investors to continue to dominate mezzanine fundings.

|

| Courtesy of Silicon Valley Bank. Click to see larger version. |

Find the full trends report here.

Jon Norris is a managing director for SVB's Healthcare practice. Norris oversees business development efforts for banking and lending opportunities as well as spearheading strategic relationships with many healthcare venture capital firms. He also helps SVB Capital through sourcing and advising on direct equity co-investment and limited partnership allocations.