|

| Dan Chen, Genentech's global development team leader for immuno-oncology |

CHICAGO--Behind the headline presentations here at ASCO, you'll find one of the biggest players in immuno-oncology quietly positioning itself to vault into a leading role in the fast-emerging market, using its in-house technology to best identify the patients most likely to respond to their checkpoint inhibitor and then rapidly exploiting that edge with a full slate of combination therapies matched to their lead program.

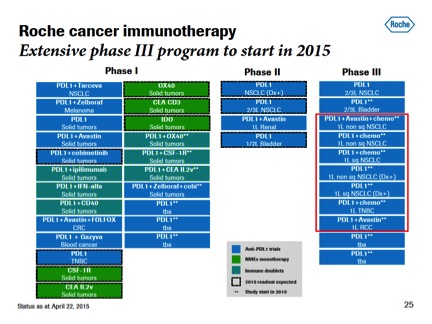

Genentech arrived at ASCO with a new name for MPDL3280A--it's atezolizumab now, or just "atezo" for shorthand--which is in 10 Phase III studies (an 11th is being readied) amid a blizzard of 36 clinical trials. An abstract to be posted here at ASCO points to newly identified subpopulations of lung cancer patients who may turn out to be ideally suited to atezo, which has "breakthrough" status at the FDA as regulators appear eager to approve these new drugs.

There's also an intriguing experimental treatment now in Phase I--the "anti-CEA" RG7802 program--that promises to add a brand new T cell approach to fighting cancer that is being lined up for a combo approach with atezo. Investigators are using bispecific antibody technology to direct a T cell attack directly against the CEA antigen that clusters on the surface of cancer cells. And Dan Chen, Genentech's global development team leader for immuno-oncology, says using that in combination with atezo "makes total sense."

Atezo just started a key adjuvant study for bladder cancer, and earlier in May Genentech posted some important survival data among non-small cell lung cancer patients who express high levels of PD-L1.

One of the key themes to emerge in immuno-oncology over the weekend at ASCO is that rivals like Bristol-Myers Squibb ($BMY), which is pushing ahead on its recently approved drug Opdivo, are finding that low levels of PD-L1 expression translate into poor response rates. And that's a trend that can deliver some major benefits for Genentech--which expects to land an initial approval for atezo in 2016 or earlier as it maps out a big future for the drug.

"There was a lot of noise" about immuno-oncology early on, says Chen. "You're now seeing it all come together."

In Chen's view, Genentech's PD-L1 target in the field--compared to the PD-1 approach by Merck ($MRK) and Bristol-Myers Squibb--gives the biotech arm of the giant Roche a shot at near-term approvals for a drug that has the potential to clearly distinguish itself from the competition. Genentech views PD-L1 as the more significant driver behind cancer, and while many of the early patient responses in the field look similar, Genentech believes it has an odds-on chance to prove that atezo can have a more durable effect on cancer with a lower likelihood of spurring toxicity.

Roche ($RHHBY) and Genentech have made biomarkers a key feature in drug development for years. This weekend, Genentech investigators are also discussing their discovery that about 10% of the non-small cell lung cancer patient population are ideal candidates for atezo. Atezo was associated with a 45% overall response rate for TC3 or IC3 tumors, compared to a 14% ORR in patients without TC3 or IC3 NSCLC, according to the abstract.

"We think that atezo specifically has potential to distinguish itself as you combine therapies," adds Chen. Their studies so far have created a tox profile in which the combination of atezo and chemotherapies match closely to chemo alone. Says Chen: "That makes us think we have a good path forward."

The bispecific antibody RG7802 treatment is "similar to but different from CAR-T," says Chen, referring to the hot new field that reengineers T cells with a chimeric antigen receptor to direct an attack against cancer cells. In this case, Genentech has designed a bispecific antibody that attaches to cancer cells as well as T cells. T cells that would normally be circulating in search of an invader like the flu are redirected to attack cancer cells. In preclinical studies, he says, it has looked like one of the most potent cancer therapies he's seen.

In Chen's view of the next few years, the development of their checkpoint inhibitors will move past chemotherapy combinations to new approaches that involve a big step up through the use of more innovative matchups, with pipeline agents coming in to amp up impact. Roche has also paired itself with immatics biotechnologies, a German biotech that's been working on new cancer vaccines. And there's an anti-OX40 approach that stimulates the production of T cells.

Genentech may not be the first to move on the market, but it's determined to make a big splash when it does arrive, and for some years to come.